The Annual Report

The annual report in English contains selected documents from the annual accounts of Veritas Pension Insurance Company Ltd. The official financial statement of Veritas Pension Insurance is available in Swedish and in Finnish at this website or at our head office in Turku.

Annual accounts

Annual accounts 2014 (pdf, 496 KB)

Established in 1905 in Turku, Veritas is among the oldest insurance companies in Finland. We have provided statutory employment pension insurances since the relevant laws became effective in 1962.

Quality customer service is one of the cornerstones of our operations. We believe in individual service and to this effect, all our customers have a named specialist as their contact person at Veritas.

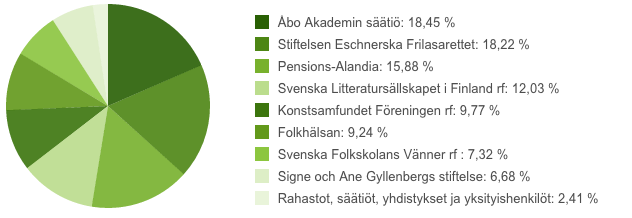

Veritas is a non-listed limited liability company whose shareholders are all based in Finland. Our shareholders include foundations, institutions and associations supporting education, health care, science and the arts.

Despite the given economic climate, the year 2014 was a good year for Veritas. We saw an increase in the number of TyEL insurance policies as well as in the total of insured YEL income, even though the number of YEL insured entrepreneurs slightly declined.

The investments yielded a good return, at 6.5 per cent. The equity market developed positively regardless of the weak growth expectations. The return on fixed investments was also good.

While we managed to achieve a good result in 2014, the adverse economic trend will be reflected in our result for 2015. The weak growth of the economy will inevitably affect the development of employment in Finland. We hope that, after the Parliamentary election, the new Government will have the necessary capability and power of action to drive the economy in a new direction.

The investment outlook is still characterised by uncertainty. The interest levels have dropped near to zero, while at the same time, the share prices remain at a high level. Without genuine economic growth, the expectations will not correspond to the currently prevailing prices.

Job satisfaction is a key to a successful customer experience

Our ability to deliver the best service in the sector is founded on the broad individual expertise and high level of job satisfaction of our personnel.

At Veritas, job satisfaction has been at a high level for several years. In the personnel survey conducted in spring 2014, the results were especially good. We clearly exceeded the standard performance for all measured indices.

The high job satisfaction is reflected in our customer service. The most important single factor behind a successful customer experience is a successful internal customer experience.

In the annual sector-specific customer satisfaction survey conducted by Taloustutkimus, Veritas was rated as the best in our industry with an overall score of 8.23. I wish to extend my gratitude to our customers for their feedback and to our personnel for their dedicated work for the best of our customers.

Intensified cooperation

In terms of the high customer satisfaction, we owe thanks to our partners, Aktia Bank, Alandia, Folksam Skadeförsäkring, Handelsbanken, Pohjantähti and POP Banks. In partnership, we are able to provide our customers with a comprehensive range of insurance and financing services.

The intense collaboration is yielding fruit: small and mediumsized companies increasingly select Veritas as their pension insurer. Our co-operation with Alandia was further deepened through the introduction of a new compensation system shared by the industry. In the future, we will, to a larger extent, be in charge of the pension processing on behalf of our partner.

I wish that we will be able to further intensify co-operation with all our partners and achieve a good result in the current year as well.

Unique pension system

In Finland, we have a unique, benefit-based pension system, the administration of which is trusted to independent private actors.

The diversity of these actors is an asset for customers. The investment strategies and decision-making processes specific to individual companies will secure future pensions and benefits better than would be the case in a centralised system with a single actor.

The Finnish system excels in terms of international comparison, as shown by the Melbourne Mercer Global Pension Index in 2014. We performed best in the integrity sub-index, which assesses governance and transparency. Finland played in the top league in the overall comparison as well, and was ranked fourth.

The new, reformed pension system being launched in 2017 will enable our system to adapt to changes taking place in society. Our average retirement age has risen, and it is imperative to find a new balance between the years in working life and on pension. A more balanced relationship between these two periods of life will safeguard the future of our system.

110 years of innovative thinking

Veritas celebrates its 110th anniversary in 2015. Over the course of the years, our operations have taken on new forms, and currently our primary duty is to secure the pensions of our customers.

During our history, the insurance sector and the operating environment have seen substantial changes. To reach the point where we stand now has required innovative ideas and a dynamic adaptability. A well-managed company with excellent key figures is capable of coping with situations that call for rapid decision making.

I wish to express my gratitude to the Board of Directors, the Supervisory Board, our personnel and our partners for their support and work well done.

Turku, Finland, April 2015

Jan-Erik Stenman

In 2014, a growing number of small and mediumsized companies selected Veritas as their employment pension insurer, and the number of employers and employees insured under TyEL increased. Despite the growth of the TyEL portfolio, the total sum of the TyEL payroll declined.

On the other hand, the total income insured under YEL developed positively, even though the number of YEL policies decreased.

The total premium income rose to 470.2 million euro.

Veritas investments yielded a good return during the period under review. Although the growth expectations remained low, the equity market developed positively. The fixed income investments yielded an excellent return in proportion to the low interest rate level.

The solvency capital totalled 595.9 million euro and was 28.9 per cent of the technical provisions. Thanks to the good investment result and strong solvency, the transfer to client bonuses increased by 10.3 per cent over the previous year.

A well-functioning work community is the key to a successful customer experience.

At Veritas, customer service is the focus for all activities. The well-being and up-to-date competence of individual employees play an essential role in our pursuit to provide the best customer service in the sector. In 2014, we developed our management practices and supported the well-being of, in particular, our ageing employees.

In our personnel survey in the spring, the PeoplePower® index*, which measures overall job satisfaction, was 75.7, meaning that Veritas exceeds clearly the standard level for white collar employees in Finland (66.7).

*PeoplePower® is a measure used by Corporate Spirit to assess, among other things, commitment, leadership and performance.

Personnel information

|

2014 |

2013 |

|

| Average number of employees |

142 |

138 |

| Gender distribution, men/women (%) |

25/75 |

23/77 |

| Gender distribution in middle and top management, m/w (%) |

38/62 |

36/64 |

| Respondents to the personnel survey, employees (%) |

97,9 |

91,4 |

| PeoplePower® index (standard for white collar employees) |

75,7 (66,7) |

72,2 (65,0) |

Salaries and remuneration

Incentive reward system

With the exception of the sales organisation, the entire personnel of Veritas is included within the sphere of the incentive reward system. No incentive rewards are paid to the members of the Board of Directors or the Supervisory Board.

Incentive rewards are paid out annually if the company reaches the objectives set by the Board.

The amount of the reward paid to an individual employee is determined on the basis of the company-level objectives and the personal objectives defined in development discussions. The monetary value of the incentive is calculated on the basis of the employeeʼs annual earnings, deducted by the incentive paid for the preceding year and any overtime compensation.

Veritas paid a total of 743,074.71 euro as incentive rewards for the year 2014.

Personnel fund

Veritas has a personnel fund, in which all employees who are in an employment relationship with the company are included as of the beginning of the month when their employment relationship has lasted five months.

The Board determines the percentage of paid salaries and remunerations, excluding possible incentive rewards, which shall be transferred to the personnel fund if and when the company achieves the performance objectives set by the Board. The total sum will be divided and allocated as fund shares to the members of the fund on the basis of their annual work days.

The profit share payable to the personnel fund for the year 2014 totals 85,881.28 euro.

The calculation and payment of fund member shares is administered by Innova Services Ltd.

Our vision is to be the best employment pension company for small and medium-sized companies and entrepreneurs.

To this aim, we offer our customers the best service in the sector. The core of our service is to safeguard the old-age living for our customers through profitable and secure investment operations, consistent counselling and the promotion of work capacity and job satisfaction.

Our values are the foundation of our customer service, cooperation and decision making.