Climate change mitigation is one of our most significant focus areas in responsible investment, and part of our corporate responsibility programme. We have set environmental targets for our investment activities: we are aiming for a carbon-neutral investment portfolio by 2035. In addition, we are striving towards carbon-neutral real estate investments by 2030. Our long-term target is for our investments to be aligned with the Paris Agreement.

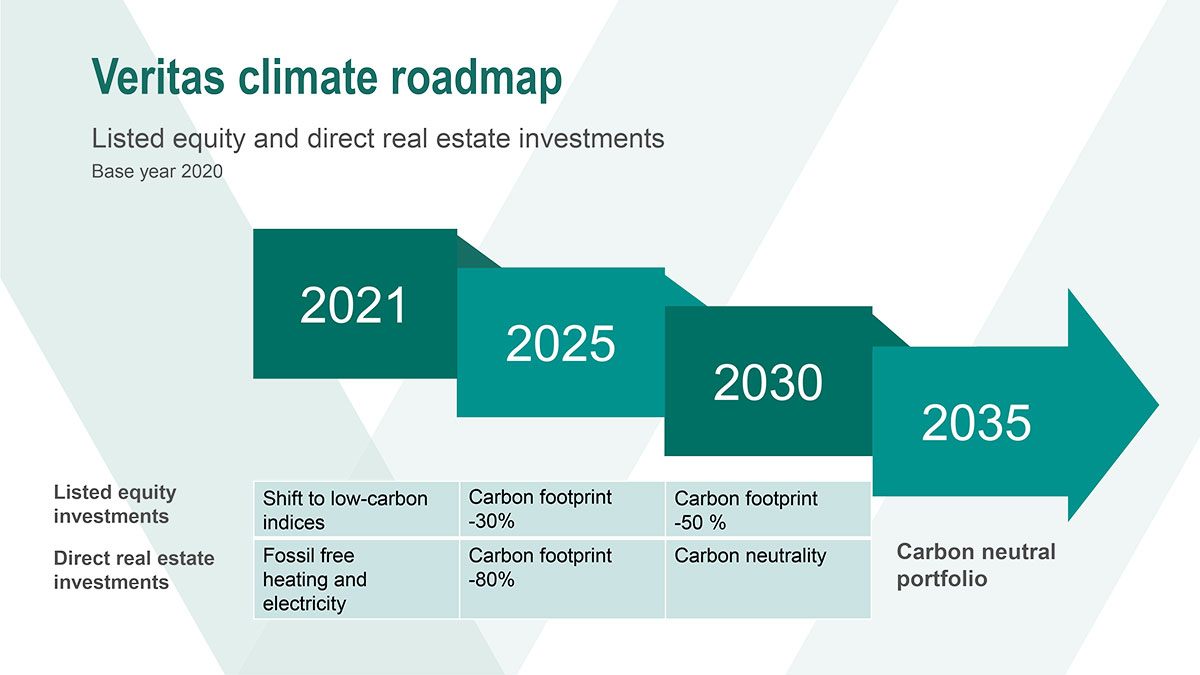

We have devised a climate policy for investments, wherein we determine our action points for mitigating the climate risks of our investment portfolio. In 2021, we supplemented our climate policy with a climate roadmap, setting forth our actions for attaining climate targets.

At the moment, the Veritas climate roadmap pertains to two asset categories: listed equity investments and real estate investments. These asset categories were selected for the first version of the climate roadmap, because there is ample data available on them.

The current climate roadmap is just the very first one of its kind and is not yet perfect. As the data coverage improves, we aim to expand the climate roadmap to encompass numerous asset categories in the future – therefore, this document will evolve with time.

In 2022, we will be launching a development project to ascertain the availability and coverage of data. We aim to increase the coverage and to add new asset categories under our climate roadmap. At the end of 2021, the coverage of the available data related to approximately 62 per cent of our portfolio.

Goal 5: We take action to decelerate climate change

140.8

Weighted carbon intensity of investment portfolio (TCFD)*

*Our goal for 2022 is to reduce our carbon intensity toward achieving carbon neutrality by 2035.

Active ownership and impacting

We believe in active ownership and impacting. We seek to impact our investment objects in an effort to mitigate climate change. We participate in numerous investment initiatives and we engage in regular dialogue with our portfolio companies in the sphere of climate considerations. For instance, we regularly send our portfolio managers an ESG survey, charting out how various responsibility factors are being taken into consideration in investment activities. In this survey, we particularly emphasise climate considerations. Furthermore, we encourage our investment objects to report in accordance with the TCFD and the EU taxonomy. Further information on impacting and our ownership can be found below in this report, under section ”Ownership Policy”.

Collaboration with other investors

In addition to PR, we have also signed the Fiduciary Duty in the 21st Century and the Climate Action 100+ initiatives. We are members of the CDP community, as well as of Finland’s responsible investment forum Finsif.

Responsible investment impacting and collaboration projects in 2021

- Exerting influence on companies in order to report on climate change in CDP organisation’s Non-Disclosure Campaign initiative

- Exerting influence on companies in order to set climate goals based on science in CDP organisation’s Science-Based Targets campaign

- PRI’s position on climate change-related information to be reported to SEC

- Considering the rights of children in investment activities consultancy for UNICEF

- Finsif’s Responsible Investment Guidebook

- Exerting influence on states to expedite climate action under the Investor Agenda initiative.