Climate change has an extensive impact on the economy and business operations, which is why it is important for an institutional investor, such as Veritas, to identify and manage risks pertaining to climate change.

From the perspective of investment portfolios, climate change is not only a risk, it is also an opportunity. Adapting to climate change entails possibilities for novel business opportunities for organisations and corporations – for instance cost savings as a result of more optimised use of resources, or new climate-friendly products through developing the earnings logic. The opportunities naturally vary according to the industry or market the relevant companies operate in.

Governance

The risks and opportunities entailed by climate change are reported to Veritas’ Board of Directors a minimum of once per year. The Board of Directors annually adopts the Principles of Responsible Investment, the Climate Policy for Investments as well as the Ownership Policy.

Also Veritas’ Executive Group is provided with regular reports, and no less than once per year, concerning responsible investment as well as the risks and opportunities entailed by climate change.

The Chief Investment Officer is responsible for the implementation of the Principles of Responsible Investment and the Climate Policy for Investments. In addition, the responsible investment steering group, headed by the Chief Investment Officer, steers the implementation of responsible investment and the Climate Policy for Investments.

The practical implementation of responsible investment is the responsibility of the investment department, and responsibility has been integrated in all investment decisions. The Chief Sustainability Officer supports the practical implementation of responsible investment and acts as the expert of responsible investment.

Strategy

The economic effects of climate change may be viewed both as risks and as opportunities. With climate change impacting the economy and business operations, it is essential for an institutional investor such as Veritas to identify and manage climate-related risks and opportunities.

The risks entailed by climate risks for investors are two-fold: physical risks and transition risks. As their name suggests, physical climate risks comprise the physical embodiments of climate change, such as various phenomena related to the increase in temperature. Such physical risks are further divided into two sub-categories: acute and chronic climate risks. Acute risks are short-lived risks arising from a specific climate or weather occurrence, such as a flood, hurricane or wildfire. Chronic risks, on the other hand, represent long-term risks, such as global warming and the economic damage ensuing from same.

Risks caused by the transition to a low-carbon economy are referred to as change-over or transition risks. Transition risks include, inter alia, political and legislative risks, risks associated with changes in technology and markets, and reputational risks.

From the perspective of investment portfolios, climate change is not only a risk, but also an opportunity. Adapting to climate change entails new earnings possibilities for organisations and businesses: cost-savings resulting from the optimised use of resources, or new revenue streams from developing innovative, climate-friendly products. The opportunities vary according to the industry or market the relevant companies are active in.

Risks

| wdt_ID | Type of risk | Risk | Time span | Potential economic impact |

|---|

Opportunities

| wdt_ID | Type | Time span | Potential economic impact |

|---|

We have identified climate risks with the most material effect on our operations. In securities investments, the most material risks are associated with transaction risks and therein, with political and legislative risks. As legislation pertaining to climate change proliferates, the risk of changing valuations increases. This is the situation especially in carbon-intensive industries, which are subject to emission rights and potential carbon tax.

Physical risks primarily relate to our real estate portfolio. Physical risks manifest themselves, for instance, in sudden flood risks, or as a longer-term effect owing to the potential rise in the sea level. This risk may be managed when selecting new portfolio companies, as well as when planning the management of existing real estate assets.

The opportunities inherent in climate change are reflected in the form of novel, climate-friendly investment opportunities as the green energy transition proceeds. In our real estate investments, energy efficiency projects generate cost savings.

Scenario analysis

We have conducted a variety of scenario analyses on our investment portfolio. Scenario analyses allow us to examine, whether our investment portfolio is aligned with our long-term objective of a climate portfolio adhering to the Paris Agreement.

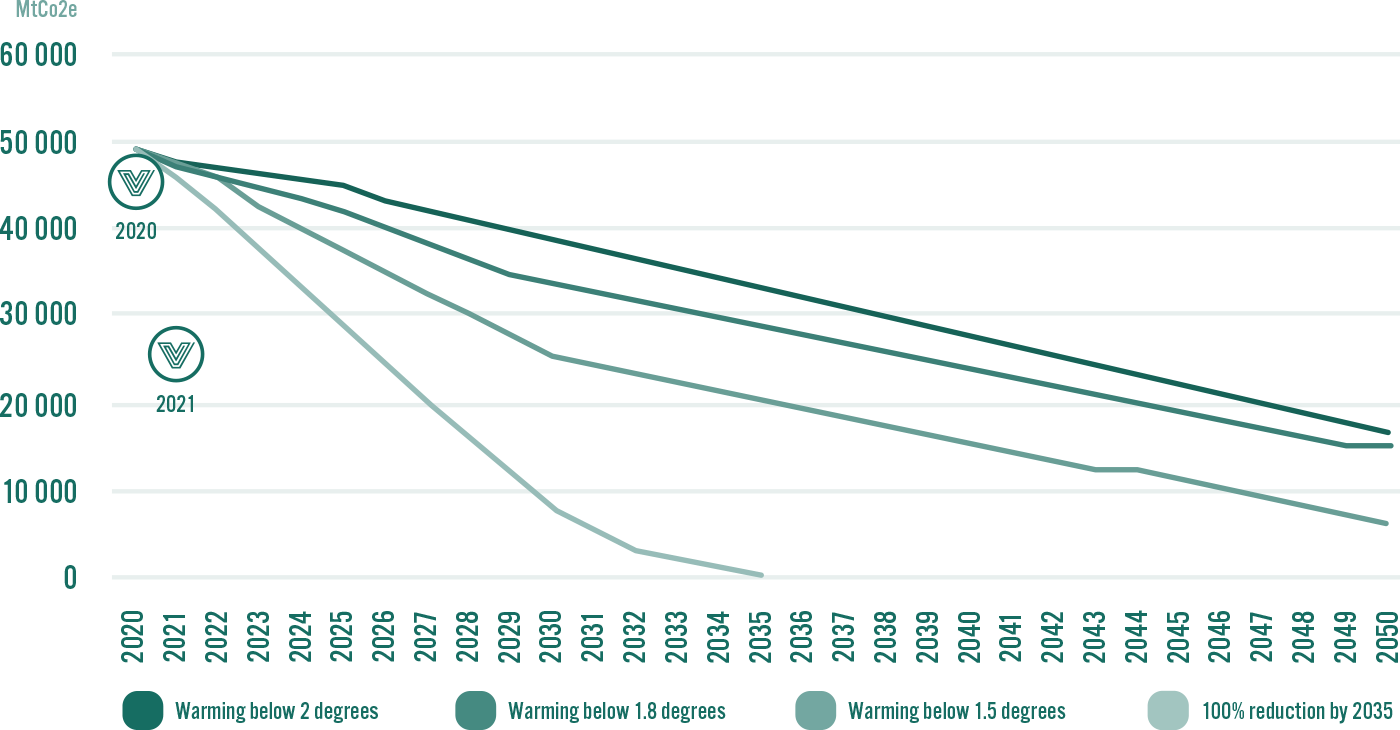

The below graph proportions Veritas’ investment portfolio in four different scenarios. The different warming scenarios (1.5, 1.8 and 2-degree) indicate by how much emissions should be reduced for global warming to remain at the degree indicated by the name of the scenario. In these scenarios, carbon neutrality must be attained latest in 2050. The latest scenario accords to Veritas’ carbon neutrality target, i.e., emissions should be reduced by 100 per cent by the year 2035.

The scenario analysis shows that the emissions of Veritas’ equity and corporate bonds portfolio are aligned both with the Paris Agreement and Veritas’ carbon neutrality target. Veritas has reduced the emissions of its equity and corporate bonds portfolio in 2021 faster than anticipated. However, as concerns the scenario analysis, it should be borne in mind that it only encompasses a portion of the entire investment portfolio.

Listed equity investments and corporate bonds in different warming scenarios

Source: UNEP Emissions Gap Report 2021

Risk management

In our climate policy for investments, we have determined measures for managing climate risks. These measures are:

- the analysis, monitoring and reporting of carbon risk

- the assessment, monitoring and reporting of the economic impacts of climate change

- leveraging influence on our investment objects to mitigate climate change.

Exerting influence on investment objects to mitigate climate change

We strive to leverage our influence on our investment objects in an effort to mitigate climate change. We are participants in a number of investor initiatives and we engage in regular dialogue with our portfolio companies in relation to climate-related matters. For instance, we regularly submit to our asset managers an ESG survey, exploring how various corporate responsibility factors have been taken into account in investment activities. In this survey, the focus lies particularly on climate-related aspects. Furthermore, we encourage our portfolio companies to report in accordance with the TCFD and the EU taxonomy. A more detailed account of leveraging our influence and of our ownership policy can be found below in this report under section ”Ownership Policy”.

We will be developing the integration of climate risk management in the risk management of the entire company during 2022. We will be assessing through reverse stress tests how different scenarios may impact our invested assets (especially our direct real estate holdings). The scenarios include, inter alia, the rise of sea level by one metre, increased floods as well as substantial climate warming in Finland. The timeline is from short-term, i.e., acute events, to long-term and chronic scenarios.

Metrics and targets

We are aiming to achieve carbon neutrality in our investment portfolio by 2035. This is a challenging goal and calls for collaboration across the financial markets. As concerns real estate investments, the target is to reach carbon neutrality already in 2030. We have determined the actions and milestones for attaining these climate goals in our climate roadmap for investments. We monitor the carbon-neutrality targets of our investment portfolio through scenario analyses, as well as through measuring the carbon footprint of our portfolio.

Veritas’ climate targets in brief

Carbon-neutral investment portfolio by 2035

- Listed equity investments:

- 2025 carbon footprint -30 %

- 2030 carbon footprint -50 %

- Real estate investments:

- 2025 carbon footprint -80 %

- 2030 carbon-neutrality

We have calculated the following carbon indicators: carbon footprint, as well as the weighted carbon-intensity recommended by TCFD. The calculation was conducted by a third-party service provider and was effected in accordance with TCFD’s guidelines, using the GHG Protocol method. The calculation encompasses Scope 1 and Scope 2 emissions, i.e., the direct emissions of companies, generated in their own operations, along with indirect emissions, generated from the company’s consumption of energy and electricity.

Veritas’ carbon indicators for 2021 were good. We have succeeded in reducing our carbon footprint in accordance with our carbon-neutrality roadmap and even faster. In equity investments, the coverage of the analysis is excellent, but, unfortunately, when it comes to fixed-income instruments, the data coverage is poor. It is not expedient to examine the fixed-income results alone, but only in connection with equity investments.

The carbon footprint of Veritas investments

| wdt_ID | 31.12.2021 | 31.12.2020 | Change | Market index corresponding to the investment portfolio on 31.12.2021 | Veritas vs. index on 31.12.2021 |

|---|

*Coverage of the analysis: listed equities 97%, listed corporate bonds 40%, listed equities and corporate bonds 86%

What is the TCFD reporting framework?

The Task-Force on Climate-Related Financial Disclosures, or TCFD, is an international reporting framework intended to facilitate the assessment of the economic impacts of climate-related risks and opportunities. The objective of the reporting recommendations is to obtain consistent, forward-looking and decision-useful information on the climate-related risks and opportunities.

The TCFD reporting framework guides organisations in reporting using four core elements: governance (G), strategy (S), risk management (R), and metrics and targets (M). Consequently, the reporting of companies reporting in accordance with TCFD’s recommendation indicates how climate change is reflected in the company’s governance model, what strategies it has in relation to climate change, how climate change is taken into consideration in risk management and the types of targets and metrics pertaining to the risks and opportunities of climate change that are in use.