1. Introduction

Statutory earnings-related pension insurance is a strictly regulated and supervised sector. The operations of Veritas comply with national and international laws, decrees and regulations issued by the authorities as well as company-wide internal guidelines and operating principles.

The Code of Conduct describes how Veritas operates in accordance with legislation and its own ethical principles. The purpose of the Code of Conduct is to provide Veritas employees with a clear protocol and expectations for their actions and to serve as a guideline for potential conflict situations. In addition, the Code of Conduct increases transparency about the activities of Veritas.

At Veritas, other internal principles, guidelines and policies complement and concretise the Code of Conduct and guide our personnel to act appropriately. Every employee at Veritas is obliged to comply with the Code of Conduct in their work.

Veritas is not involved in any political activity.

The Code of Conduct was approved by the Board of Directors at Veritas on 22 January 2019. The Code of Conduct is updated and approved by the Board of Directors annually and was previously updated on 19 September 2023.

2. We operate responsibly

At Veritas, responsibility is included in everything we do. The ethical principles underlying our Code of Conduct support the responsibility work at Veritas on the basis of four focus areas.

Our customers and beneficiaries represent our key stakeholders and the basis for our entire existence. Personal service and good accessibility are the basic elements of our customer service. They enable for individual and high-quality guidance on all matters related to earnings-related pension insurance.

Responsible investment. We invest pension funds in a profitable and secure manner. When making investment decisions, we consider economic factors as well as factors related to the environment, social responsibility and good governance. Our investment activities are guided by our principles of responsible investment.

Good governance. As a pension company, we manage a vital societal task that is governed by laws and regulations. For this reason, it is important that what we do is transparent and in line with our task. Alongside legislation, we have comprehensive internal operating guidelines in place. These guidelines and related personnel training ensure that all employees at Veritas are complying with the common company rules.

Responsible employer. At Veritas, the basic elements of a responsible workplace include co-operation, renewal, integrity, transparency, flexibility and fair treatment. We do everything in our power to create a positive employee experience. The building blocks of a positive employee experience at Veritas include meaningful work, extensive engagement of employees and opportunities to influence, fair and equal treatment, an open and interactive communications culture and, as the underlying foundation, good leadership.

Veritas has determined responsibility targets for each focus area that are monitored with the help of specific indicators. Further information about our approach to responsibility can be found on our website at https://veritas.fi/en/about-us/responsibility/.

3. We observe good insurance practices in our business operations

Veritas observes the law and good insurance practices, as approved by the company’s Board of Directors, in its business operations and contractual relations with its policyholders. The business transactions between Veritas and its policyholders shall be market-based as concerns pricing and other conditions. When working with our customers, we adhere to our ethical principles and treat our customers equally.

We make our pension and insurance decisions in accordance with legislation, legal usage and the application directives provided by the Finnish Centre for Pensions. It is important for us that our decisions are fair and in line with the common praxis. We justify our decisions in an understandable way and are happy to answer any questions related to them. The fundamental basis of our customer service is always to provide our customers with swift, thorough, equal and personal service.

Veritas uses no inappropriate arrangements in its relationships with policyholders or other business activities. An arrangement may be considered inappropriate, for example, if business activities related to earnings-related pension insurance or investments require the acquisition or use of insurance or other services by insurance companies belonging to the same group.

4. We know our customers

The obligation of an insurance company to know its customers and their businesses is central in both Finnish pension legislation (Employees Pensions Act, TyEL, and Self-Employed Persons’ Pensions Act, YEL) and the Act on Preventing Money Laundering (AML Act). Veritas identifies and knows its customers and the quality and extent of their businesses. In earnings-related pension insurance, a customer must be identified in order to fulfil the conditions for insurance purposes.

Our customers, as intended by the Act on Preventing Money Laundering, are our policyholders, borrowers and tenants.

5. We do not accept bribery

Veritas condemns any form of direct or indirect bribery. Gifts given or received must not endanger the company’s independence. When offering or receiving gifts or hospitality, one must always consider the requirements of legislation and the internal principles of the company. Veritas has Board-approved internal anti-bribery principles that are intended to prevent misconduct and to help identify bribery situations.

6. Conflicts of interests must be prevented

A conflict of interest refers to a situation in which Veritas’s decision-making or the independence of its preparation would be compromised or appear to be compromised by personal interest or the pursuit thereof.

Situations involving a conflict of interest must be identified and the emergence thereof must be prevented. An employee of Veritas cannot participate in the processing of an agreement between themselves and Veritas. Personal interest may not impact any aspect of the decision-making process. If an employee encounters an assignment that involves a relative or an acquaintance, the employee must transfer the handling of the case in its entirety to a colleague. No one may participate in the processing of a matter that involves Veritas and, for example, a service provider or customer company with which that person is associated, e.g. through employment or by being a member of its administrative bodies, and where the interests of the person in question conflict with the interests of Veritas.

All new employees of Veritas must notify the company of possible membership in an administrative body at the start of the employment relationship. Furthermore, employees at Veritas must notify the company of any new potential memberships in administrative bodies prior to accepting the membership. Providing a list of the administrative body memberships prevents conflict of interest situations and helps to identify such situations should they occur. Memberships in boards of housing co-operatives or in non-profit associations need not be notified.

The principles of ownership steering are applied when the membership in an administrative body concerns a corporation in which Veritas is an owner.

In such cases, the procedure is as follows:

The Board of Directors decides on the participation of the CEO or deputy CEO in the administrative bodies or committees of other companies or corporations.

The CEO decides on the participation of a member of the executive team or any other employee at Veritas in the administrative bodies or committees of other companies or corporations, with the exception of such property companies that are partly or entirely owned by Veritas, for which the decision is made by the Chief Investment Officer.

The members of the Board at Veritas are bound by the disqualification regulations in the legislation governing earnings-related pension insurance companies. A member of the Board of Directors at Veritas is disqualified from participating in Board discussions on a matter involving a party in which the member is employed or serves as a member of an administrative body.

A supervisor must be informed immediately of all conflict of interest situations.

7. Significant business transactions with insider members are dealt with by the board of directors and are published

Related party transactions refer to any legal transaction with related parties, irrespective of their subject matter or title, in which Veritas represents the other party.

Any business transaction between an earnings-related pension insurance company and its management must be in keeping with the company’s interests. For this reason, any significant business transactions with related parties that are undertaken by the pension company will be discussed and handled by the company’s Board of Directors and published on the company’s public websites.

At Veritas, related party transactions are to be dealt with by the Board of Directors when the company’s interest exceeds EUR 5,000 or when the transaction is considered significant for other reasons. The significance of a transaction is assessed separately for each case.

8. We handle information confidentially and we follow data protection obligations

In order for us to realise the statutory management of earnings-related pension security, we must process confidential information. Veritas processes all confidential information concerning companies and individuals meticulously and as stipulated by law and regulation, and we never disclose information, without consent or a specific provision, to any party other than the party concerned.

All stages involved in the processing of personal information must comply with the principles for data protection and security approved by Veritas. The data protection and data security competence of our personnel is maintained through regular training and up-to-date instructions, and we consider data security factors in all aspects of our activities.

Further information about how we handle personal data can be found in the privacy statements at https://veritas.fi/en/data-protection.

9. Our insider guidelines promote reliability

The misuse of insider information refers to the use of confidential and sensitive company information for unethical or illegal purposes. The misuse of insider information is absolutely forbidden at Veritas, regardless of where and how such information was obtained. The ban on the use of insider information is applicable to all Veritas employees.

Veritas complies with Insider Guidelines confirmed by the company’s Board of Directors. The Guidelines have been drawn up to promote the public reliability of our investment operations as well as the personnel’s knowledge of insider regulations, so as to ensure they are not violated, even unintentionally.

Veritas maintains a register of permanent insiders.

10. Everyone can boldly be themselves

At Veritas, we believe that the basic elements of a responsible workplace include co-operation, adaptability, honesty, transparency, flexibility and fair treatment. Everyone at Veritas is doing meaningful work as a part of the Finnish pension system.

We treat our employees equally and emphasise the importance of good and responsible management. We nurture the well-being at work and competence of our personnel, and we support the development of that competence to better meet the demands of the changing operational environment.

Appropriate workplace behaviour is expected from all employees. Should any inappropriate behaviour occur, it will be dealt with immediately. Veritas has absolute zero tolerance for harassment, discrimination and bullying.

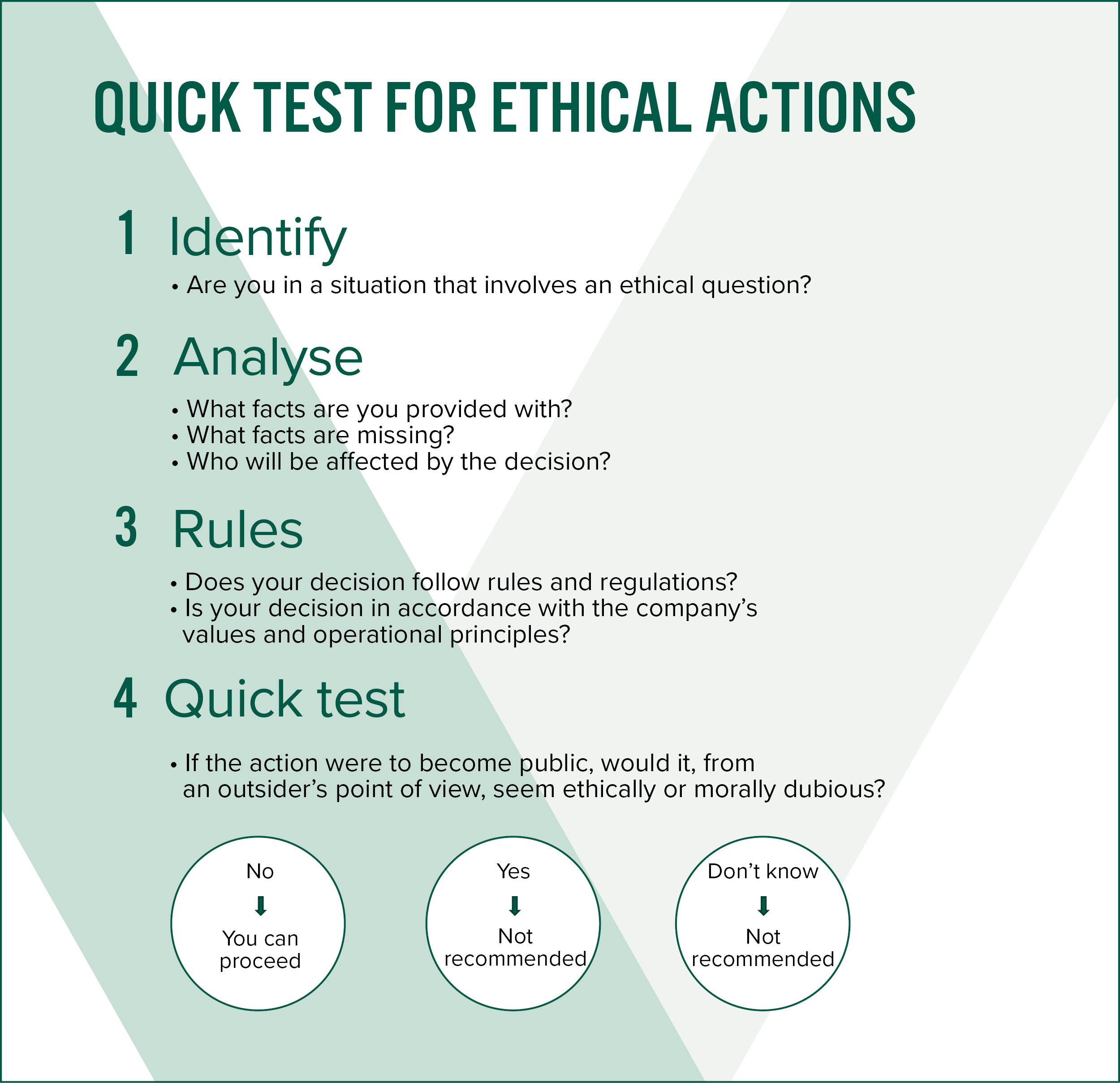

Compliance with the code of conduct

Every new employee at Veritas is familiarised with the company’s Code of Conduct and underlying ethical principles. All personnel are obliged to regularly complete the online compliance course that includes a review of the principles.

Each employee at Veritas is responsible for doing their part to ensure that the company is acting in compliance with the valid laws, regulations and operating guidelines. The management of each business sector is responsible for assuring that the roles and responsibilities as well as the reporting obligations are clearly defined within the organisation.

If a lack of compliance with regulations or operational principles is observed and there are risks involved in the situation, the observer has an obligation to report the matter to the company’s compliance function. Veritas has a whistleblowing channel for the reporting of misconduct. The channel enables employees to report suspected violations of laws or other regulations. All reports are processed confidentially.