Financial information and investments

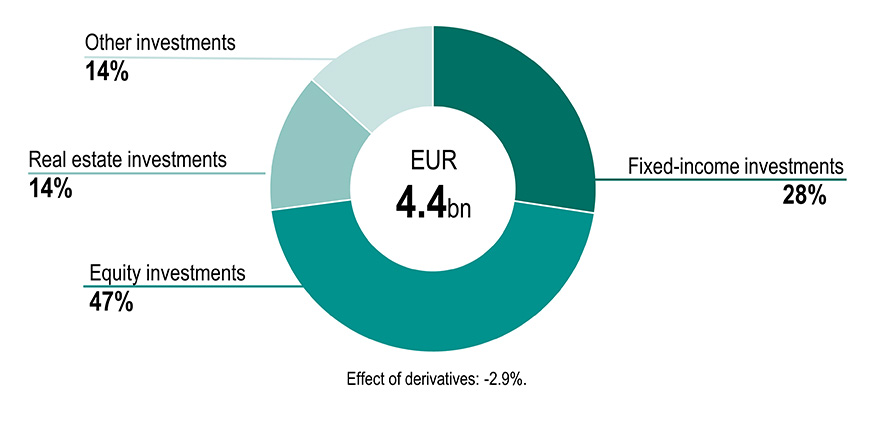

The return on Veritas’ investments was 5.7 per cent in 2023. The return on fixed-income investments was 7.8 per cent, equity investments 8.7 per cent, real estate investments -4.1 per cent and other investments 4.8 per cent.

“As regards our returns, 2023 was a near mirror image of the previous year. The return on fixed-income investments was quite positive and credit investments had double digits returns”, shares Kari Vatanen, CIO at Veritas.

Returns on illiquid investments were overshadowed by liquid market returns. Real estate investments suffered from decreased valuations in a higher rate environment.

- Press release: Veritas Financial statement Report 2023: Veritas in 2023: Veritas gained a record amount of new customers (16 February 2024)

- Financial statement presentation 2023 (pdf)

Archive

News

Investment allocation by asset class

31 December 2023

Investment activities

We invest our accrued funds profitably and securely as a means of ensuring future pensions. The aim of our investment activities is to achieve the best possible return in order to ensure sustainable funding for pensions.

Our investment activities are professional, independent and responsible. We utilise a wide range of different revenue sources and diversify our investments internationally among different asset classes. Our investments comprise fixed-income investments, equity investments, real estate investments and other alternative investments.

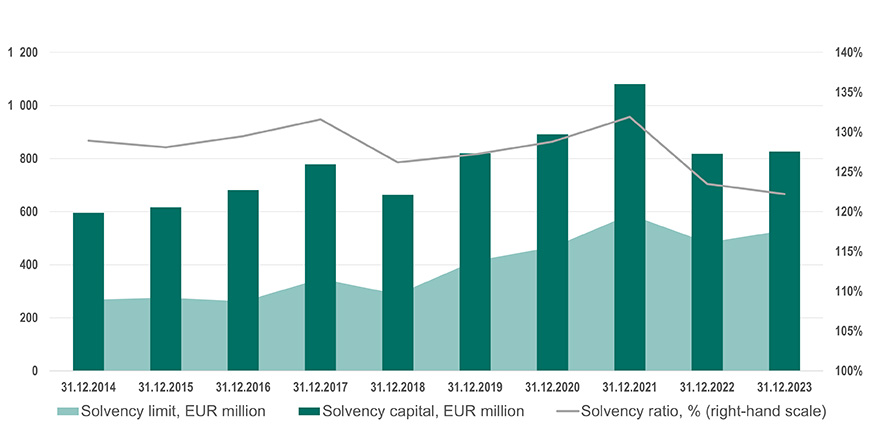

Solvency

Veritas’ solvency position remained at a solid level at the end of the year, at 1.6-fold compared to the solvency limit. The solvency ratio was 122.2 per cent.

The solvency capital serves as a risk buffer for the purposes of our investment activities and against insurance risk. It determines the pension provider’s capacity to bear risk and pursue higher returns on investment activities. High investment returns increase a pension provider’s solvency and, correspondingly, the solvency decreases during weaker investment years.

Veritas’ solid solvency position safeguards pension funds