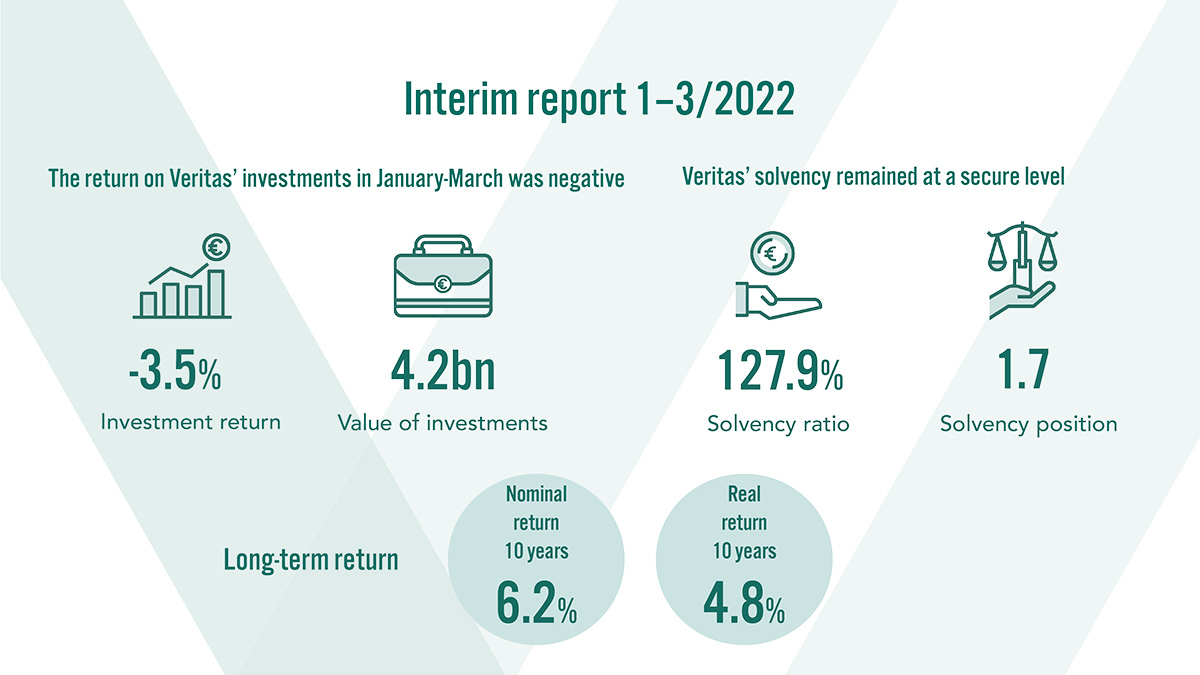

The return on Veritas’ investments in January-March was negative. Nevertheless, the record-breaking investment returns of last year and Veritas’ solid solvency position safeguard pension funds in the deteriorating market conditions.

In terms of customer acquisition, however, Veritas’ first quarter was very promising.

”In the first quarter, the number of insurance policies transferring to our company, when measured in the actual number of insurance policies, was higher than ever before”, reports Veritas’ acting CEO Tommy Sandås.

Positive returns hard to come by

During the first quarter of this year, the return on Veritas’ investments amounted to -3.5 per cent. Fixed-income instruments yielded -3.0 per cent, equity investments -6.8 per cent, real estate 1.2 per cent and other investments 3.0 per cent.

”The equity market has been declining as a result of the soaring inflation and rising interest rates, along with the war in Ukraine. In traditional asset classes, negative returns have been unavoidable. However, alternative and illiquid investments with slower reaction times have still been generating positive returns”, says Veritas’ Chief Investment Officer Kari Vatanen.

According to Vatanen, the outlook in the investment market in the coming months is bleak. We are in for high inflation, tightening monetary policy and declining growth.

”Albeit the world is currently looking uncertain and grim, there is no reason for concern when it comes to the pension system. The high returns generated last year have ensured that we are well-equipped to tackle this year”, Vatanen relays.

Veritas’ solvency remained at a secure level and at the end of March was 1.7-fold compared to the solvency limit. The solvency ratio amounted to 127.9 per cent.

Carbon footprint has declined faster than targeted

Veritas has set itself the target of developing its investment activities towards a more responsible direction and to render its investment portfolio carbon neutral by the year 2035.

”Last year, we managed to decrease our carbon footprint faster than targeted. In real estate, emissions have been reduced by as much as 73 per cent since the starting level of 2020”, says Vatanen.

According to Vatanen, the start of the year has been particularly challenging for responsible investments.

”To put it crudely, one could say that in the first part of the year, responsibility has not been a profitable choice in the investment market. The best returns were generated, for instance, within the energy sector and the defence industry, which responsible investors typically shun.”

Appendices:

Further information:

- Tommy Sandås, Interim CEO, CFO, tel. +358 (0)10 5501 786, firstname.surname@veritas.fi

- Kari Vatanen, CIO, tel. +358 (0)10 550 1882, firstname.surname@veritas.fi