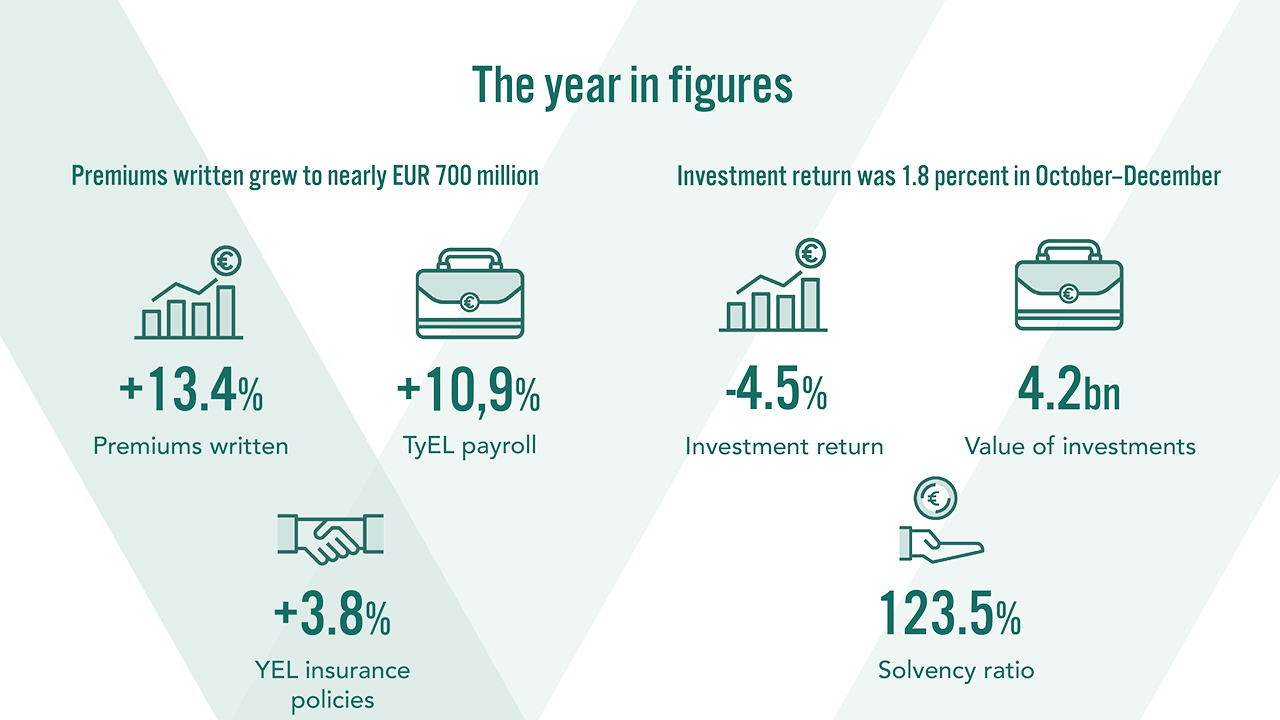

Pension Insurance Company Veritas delivered strong growth in the year 2022. Veritas’ premiums written grew by 13.4 per cent, to nearly EUR 700 million. At the end of the year, Veritas provided insurance cover for nearly 68 000 employees and over 14 000 entrepreneurs.

”In terms of sales, the year was our all-time best if measured in euros. The number of YEL insurance policies continued to grow for the fifth consecutive year,” says Veritas’ Chief Executive Officer Carl Haglund.

Haglund believes that the underlying cause of such growth is Veritas’ strong commitment to personal service.

”Pension insurance matters may feel complex, but taking care of them does not need to be that. At Veritas, every single customer is assigned a designated contact person whom they may call directly. Even difficult matters are easy to tackle when you are dealing with someone you know,” Haglund explains.

The payroll of the companies insured by Veritas increased during the year by 10.9 per cent.

”The increase in the payroll is not merely indicative of the increase in the number of customers, but also of the fact that many of Veritas’ customer companies have been able to hire additional employees during the year. This is truly wonderful news,” says Haglund.

Veritas solvency position was at a solid level at the end of the year: 1.7-fold compared to the solvency limit. The solvency ratio amounted to 123.5 per cent.

Alternative investments as the bright spot

In the last quarter of the year, the return on Veritas’ investments amounted to 1.8 per cent, but the overall return for the year remained negative at -4.5 per cent. Fixed-income investments generated a return of -7.4 per cent, equity investments a return of -8.4 per cent, real estate investments 3.3 per cent and other investments 10.3 per cent.

”Investment return was positive in the latter half of the year despite the difficult market environment. Alternative investments served as the bright spot of the year, with their positive development mitigating the negative return impact of the equity and fixed-income markets,” says Veritas’ Chief Investment Officer Kari Vatanen.

The year was a challenging one for investors due to the rapid changes in the market environment. The pandemic fears of the beginning of the year receded as Russia attacked Ukraine. As the year progressed, the global economic outlook became increasingly bleak and inflation accelerated.

”The mild winter was a stroke of luck for Europe. It allowed us to avoid the worst of the energy crisis,” says Vatanen.

According to Vatanen, the economic situation is currently looking slightly brighter than it did just a few months ago.

”The gross domestic product of the euro area increased by 0.1 per cent in the last quarter of the year, and inflation is decelerating. This gives rise to hopes that it is still possible to avoid a severe recession.”

The development of the pension system for entrepreneurs must be continued

An exceptionally high index increase was applied to pensions at the turn of the year. This propelled the growth in the number of pension applications in all pension insurance companies last fall.

”At Veritas, the number of applications doubled during the period of October through December compared to the equivalent time period in the preceding year. It is likely that at the beginning of the year, the application volumes will return to normal,” says Haglund.

Amendments were also made to the Self-Employed Persons’ Pensions Act at the turn of the year. Going forward, pension companies will be reviewing the YEL income of entrepreneurs on a regular basis, every three years.

Haglund is of the view, however, that the development of the pension system for entrepreneurs needs to be continued further.

”The Self-Employed Person’s Pensions Act entered into force in 1970 and has remained largely unaltered. The world evolves in the span of fifty years, and the system must evolve with it.”

Attachments:

Further information:

- Carl Haglund, Chief Executive Officer, tel. +358 (0)10 550 1600, firstname.surname@veritas.fi

- Kari Vatanen, Chief Investment Officer, tel. +358 (0)10 550 1882, firstname.surname@veritas.fi

Veritas is a responsible and financially solid pension company handling the pension security of more than 120 000 people. At the end of 2022, the value of Veritas’ investments amounted to EUR 4.2 billion.