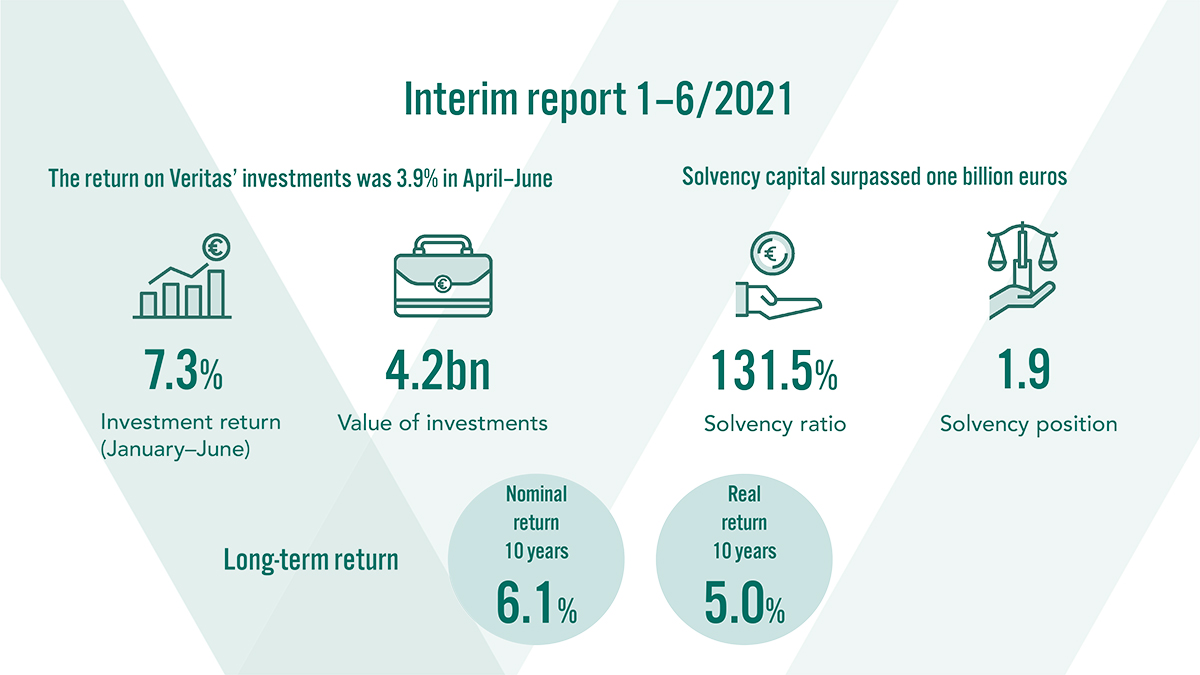

The total return on Veritas Pension Insurance’s investments was 7.3 per cent in the first half of the year and solvency grew to 131.5 per cent. Veritas’ solvency capital surpassed one billion euros for the first time.

“The second quarter set a new record for us in terms of customer acquisition. It demonstrates in a concrete way that Veritas’ investment in entrepreneur customers and personal service is appreciated,” says Tommy Sandås, interim CEO of Veritas.

According to Sandås, early 2021 was bleak for many client companies, but things started to look brighter as the spring progressed.

“In the second quarter, the total payroll of Veritas’ client companies increased clearly and the number of insured rose,” says Sandås.

Equity investments generated a return of 15.4 per cent

The second quarter also looked bright in the financial markets. The total return on Veritas’ investments was 3.9 per cent in April–June and 7.3 per cent in the first half of 2021. In January–June, equity investments performed best, with a return of 15.4 per cent. Real estate investments had a return of 2.8 per cent, fixed-income investments 0.9 per cent, and other investments 5.9 per cent.

“The continuation of economic recovery has ensured a good return on investments. The investors who dared to bear the most equity risk were the ones who performed best in early 2021. Other asset classes have had positive investment returns, but lower in comparison to equities,” analyses Kari Vatanen, CIO of Veritas.

The strong investment return strengthened Veritas’ solvency and the solvency capital surpassed one billion euros for the first time.

“Even though we have just survived a very serious pandemic-induced crisis, the return on investments for the last ten years is very high. The ten-year real return of Veritas’ investments rose to 5.0 per cent and it is very difficult to foresee that we will see this kind of returns in the next ten years,” says Vatanen.

Recovery from the pandemic continues

The situation in the Finnish economy and labour market is now bright, but many uncertainties remain.

“In the equity market, recovery from the pandemic continues with supportive monetary policy. Companies’ strong profit growth supports the stock market for now, but the risks include rising consumer prices and the prolongation of the pandemic. The sentiment in the market can change quickly, if the central banks threaten to stop playing the music,” Vatanen explains.

Interim report 1 January – 30 June 2021 (pdf)

Further information:

- Kari Vatanen, CIO, tel. +358 (0)10 550 1882, firstname.lastname@veritas.fi

- Tommy Sandås, Interim CEO, CFO, tel. +358 (0)10 550 1786, firstname.lastname@veritas.fi