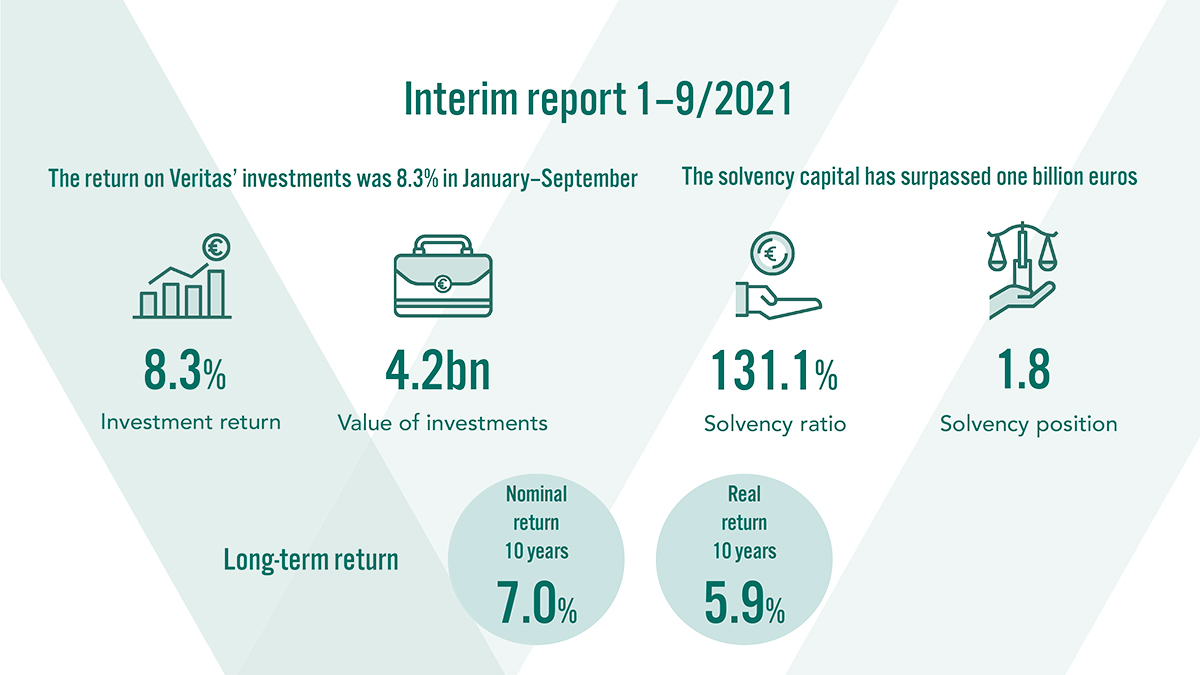

The total return on Veritas Pension Insurance’s investments was 8.3 per cent in January–September. The good investment return has strengthened Veritas’ solvency during the year. The solvency capital has surpassed one billion euro, which is 1.8 times the solvency limit. The solvency ratio was 131.1 per cent at the end of September.

The year has progressed well, also from a customer acquisition standpoint, and Veritas’ premiums written will likely exceed 600 million euro during this year.

“Our market share has particularly increased in terms of YEL insurance policies. Our strong points include our excellent customer service and a dedicated contact person, which is offered to all our customers regardless of the size of their business,” states Tommy Sandås, Interim CEO of Veritas.

“The beginning of the year has been very strong for us in terms of customer acquisition and retention. We have achieved record-high sales and clearly improved our customer retention. Our personal and active service approach obviously works and our customers value the expertise and availability of their dedicated Veritas experts,” says Mika Paananen, Chief Customer Officer.

Uncertainty continues to cast a shadow over the investment market

Veritas’ equity investments performed best during the period of January–September, with a return of 17.2 per cent. The return on real estate investments was 4.1 per cent, fixed income investments 1.3 per cent and other investments 5.9 per cent.

“The third quarter of the year was two-fold in terms of investment returns: the market recovery turned to inflation concerns towards the end of the summer and the best returns were achieved from slow-moving illiquid investments,” explains Kari Vatanen, CIO of Veritas.

The investment market continues to be overshadowed by uncertainty. The economic recovery from the COVID-19 era continues, but the rise in energy prices and supply chain bottlenecks are increasing supply side inflation, thereby worrying investors.

According to Vatanen, the market is seeing a resurgence of inflation fears. The first was experienced at the start of the year in the wake of the massive fiscal stimulus in the US, as the growth in demand drove up inflation expectations and long-term interest rates.

“Inflation fears have re-emerged, but in a slightly different way than they did at the start of the year. This time around, inflation has been impacted by supply chain bottlenecks. The resulting scarcity is causing a rise in the price of goods and energy, in particular.”

Energy inflation has accelerated, propelled by price increases in natural gas and oil, resulting in higher electricity prices, especially in Central Europe. At this stage, Vatanen does not, however, believe that the acceleration in inflation will become a permanent trend.

“We are transitioning from restrictions back to more normal circumstances, which will inevitably be reflected in prices. Supply chains have suffered as a result of the pandemic and it will take time for them to recover. Longer-term inflation growth would require a more significant increase in wage inflation, but it is unclear whether that can be afforded in a recovery financed by debt.”

Emissions from real estate down by 76 per cent

Veritas targets a carbon-neutral investment portfolio by 2035. During recent years, Veritas has particularly invested in the reduction of the carbon footprint of its real estate portfolio, as the objective is to achieve carbon neutrality in that area already by 2030.

“We are ahead of our own objective. From 2018 to 2020 we have reduced the emissions of our real estate portfolio by as much as 76 per cent,” Vatanen states.

Interim report 1 January–30 September 2021 (pdf)

Further information:

- Tommy Sandås, Interim CEO, CFO, tel. +358 (0)10 550 1786, firstname.lastname@veritas.fi

- Kari Vatanen, CIO, tel. +358 (0)10 550 1882, firstname.lastname@veritas.fi