The financial recovery has continued during the third quarter of the year, but insecurities triggered by the coronavirus epidemic and the US presidential elections remain significant, and recovery from the corona crisis has been very uneven.

‘The financial recovery process has taken on a K-shape. Some fields are doing well, while others are doing very poorly’, states Kari Vatanen, CIO of Veritas. ‘Although the manufacturing industry has begun to bounce back, the service sector continues to suffer.’

The exceptional situation brought on by the coronavirus has particularly impacted the turnover in service industries. The challenges they are facing are also reflected in the number of lay-offs and unemployment figures.

‘The situation, for example, in the areas of Åland and Lapland is difficult. For Åland, the GDP is expected to shrink by up to 16 per cent this year’, explains Carl Pettersson, CEO of Veritas.

Throughout the coronavirus crisis, Veritas has offered its customers payment extensions on their pension contributions and tenants were granted flexibility as well. Employers were also given a temporary discount on their TyEL contributions until the end of the year.

‘We have been there to support our customers and will continue to do so. We also advise entrepreneurs and companies on issues concerning work ability management. It’s worthwhile to contact us immediately if the situation looks challenging,’ Pettersson adds.

Investment returns continued to recover

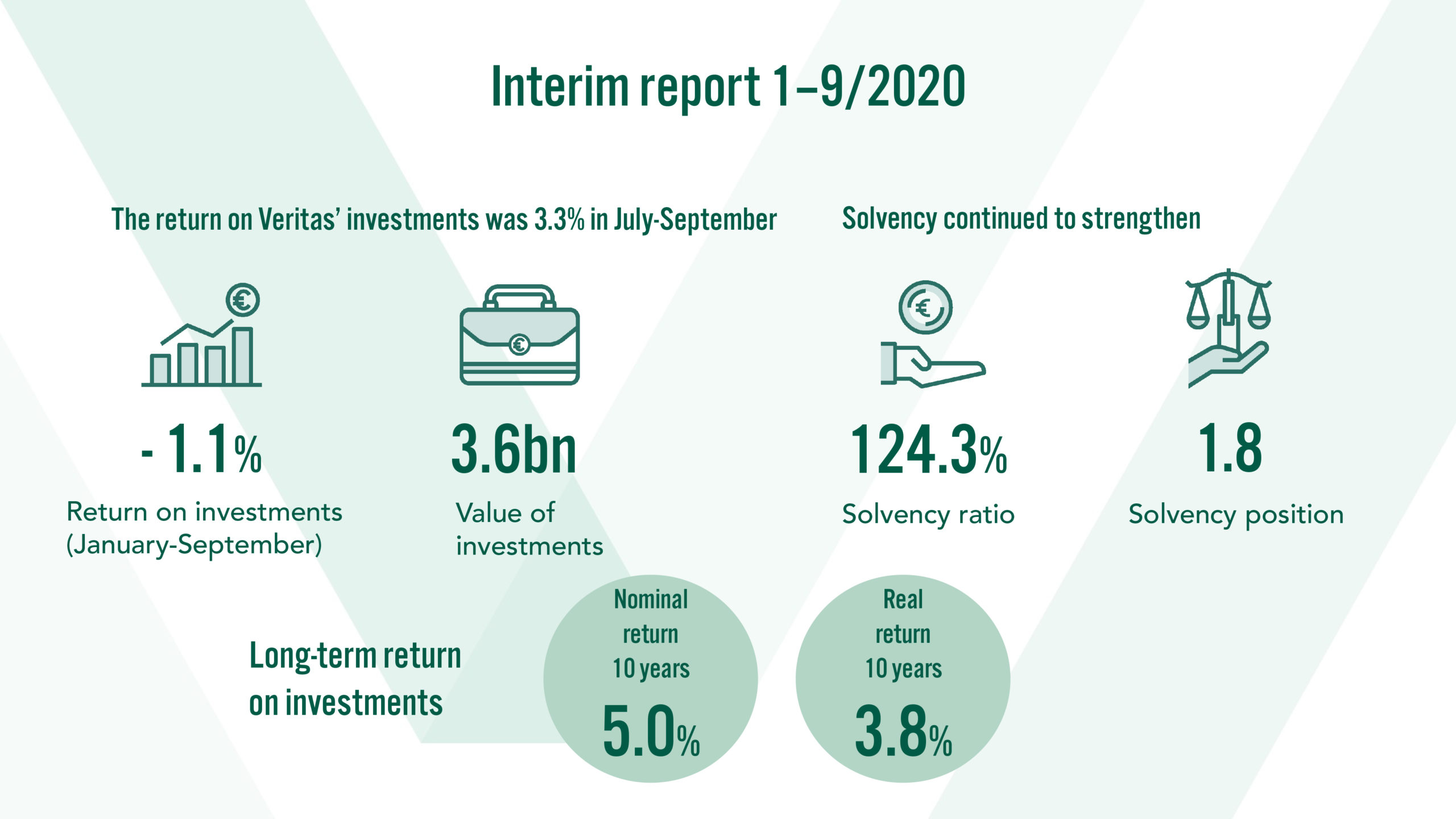

The return on Veritas’ investments was 3.3 per cent in the third quarter. The return for the entire year remains, however, negative, at -1.1 per cent. For the period of January–September, the return on fixed income investments was 1.2 per cent, equity investments -3.5 per cent, real estate 3.5 per cent and other investments -5.1 per cent.

‘This year, the diversification of investments has not paid off. Risks were realised in different asset classes at the same time and a positive investment yield has been achieved by a few industries that have suffered minimally as a result of the corona crisis. On the whole, the effect of diversification has decreased due to the growing central bank stimulus’, says Vatanen.

Veritas’ solvency has remained strong throughout the entire corona crisis. The solvency ratio increased during the third quarter and was 124.3 per cent at the end of September. The solvency position was 1.8.

Number of YEL and TyEL customers increased

The corona crisis is also reflected in the financial results of pension insurance companies this year. The premium income is affected by the general employment situation and the temporary decrease in TyEL contributions.

Veritas’ premium income was EUR 547.3 million for the period of January–September, as compared to EUR 592.7 million in 2019. The estimate for the annual payroll sum for all TyEL customers is at a lower level than the previous year, but the number of TyEL insurance policies has increased slightly. The number of YEL insurance policies has also increased and the YEL income sum is anticipated to be at a higher level in comparison to the previous year.

‘During difficult times, we respond with a heightened focus on the quality of customer service. At Veritas, it’s all about people serving people and I believe that, at times like this, our approach is highly valued’, says Pettersson.

Interim report 1 January – 30 September 2020 (pdf)

Further information:

- Carl Pettersson, CEO, tel. +358 (0)10 550 1600, firstname.lastname@veritas.fi

- Kari Vatanen, CIO, tel. +358 (0)10 550 1882, firstname.lastname@veritas.fi

- Tommy Sandås, Financing Director, tel. +358 (0)10 550 1786, firstname.lastname@veritas.fi