Veritas’ strong growth continued in 2023. During the year, Veritas Pension Insurance Company gained more than 5,100 new TyEL and YEL insurance policies to manage. The new premiums written totalled EUR 108.2 million.

At the end of year, nearly 66,000 employees and 15,000 self-employed persons were insured by Veritas.

‘Veritas’ sales achieved a new record last year both in terms of policy figures and premium income’, says Carl Haglund, CEO of Veritas.

According to Haglund, the positive result was not achieved with any magic tricks but by the company’s strong focus on customer service.

‘In today’s world, it is quite rare to have phone calls answered in less than 20 seconds. In that respect, we have certainly been swimming upstream. Veritas provides every customer with a dedicated contact person and their direct contact information.’

Veritas also regularly surveys its employee experience. Last year, the company achieved a record high eNPS result (40) from the survey.

‘The employee experience forms the foundation for everything. When you look after your employees well, they, in turn, will look after the customers well.’

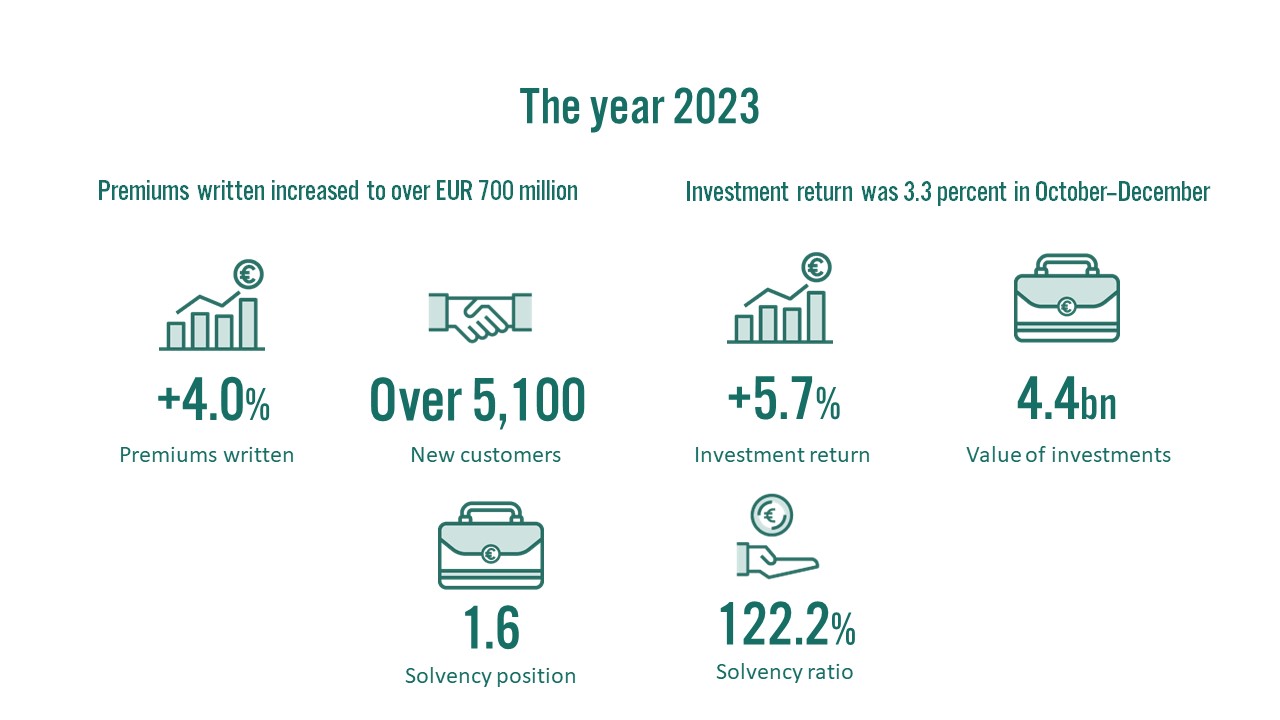

Veritas’ premiums written increased by 4 per cent over the previous year and was EUR 724 (696.5) million. The TyEL payroll of companies insured by Veritas grew by 4.4 (10.9) per cent.

‘The employment situation weakened during the autumn and the number of bankruptcies increased. It appears that spring may continue to be challenging for Finnish companies. In the last half of the year, interest rate cuts may bring long-awaited relief and rejuvenate the economy’, Haglund states.

Veritas’ solvency position remained at a solid level at the end of the year, at 1.6-fold (1.7) compared to the solvency limit. The solvency ratio was 122.2 (123.5) per cent.

The return on Veritas’ investments stood at 5.7 per cent

The return on Veritas’ investments during the year was 5.7 (-4.5) per cent. The return on fixed-income investments was 7.8 (-7.4) per cent, equity investments 8.7 (-8.4) per cent, real estate investments -4.1 (3.3) per cent and other investments 4.8 (10.3) per cent.

‘As regards our returns, 2023 was a near mirror image of the previous year. The return on fixed-income investments was quite positive and credit investments had double digits returns, shares Kari Vatanen, CIO at Veritas.

Economic growth during the year remained more stable than anticipated and the central banks continued to fight inflation up until the end of the year. As inflation decelerated, however, the market interest rates turned downward in October.

‘The fall in interest rates benefited the equity market. As a result, we got an early Christmas present – a two-month final spurt in the investment market.’

According to Vatanen, the rise in interest rates during the year made things difficult for the real estate market in particular. The number of real estate transactions plummeted, and the valuations of properties were decreased. For Veritas, this meant negative real estate returns.

‘The start of the year remains challenging for the domestic economy. Purchasing power, however, is increasing and, as we approach summer, we can already expect a gradual downward trend in interest rates. This will likely stimulate the real estate market and the economy in general.’

Appendix:

Further information:

- Carl Haglund, CEO, tel. +358 (0)10 550 1600, firstname.lastname@veritas.fi

- Kari Vatanen, CIO, tel. +358 (0)10 550 1882, firstname.lastname@veritas.fi

The figures have not been audited. The comparative figures in brackets refer to the corresponding period of the previous year.