The coronavirus epidemic has thrown a shadow over the second quarter of the year. During the first half of the year, Veritas provided support for its customer companies to ensure their ability to survive the worst phase of the epidemic. Customers were offered payment extensions on their pension contributions and tenants were granted flexibility as well.

‘Our customer companies have fared better than expected despite the impact of the first wave of the coronavirus’, states Carl Pettersson, CEO of Veritas. ‘Once again, the number of corona cases has started to rise and our fear is that it may have an even greater impact on businesses this time around. There may no longer be a sufficient capacity for flexibility and buffers.’

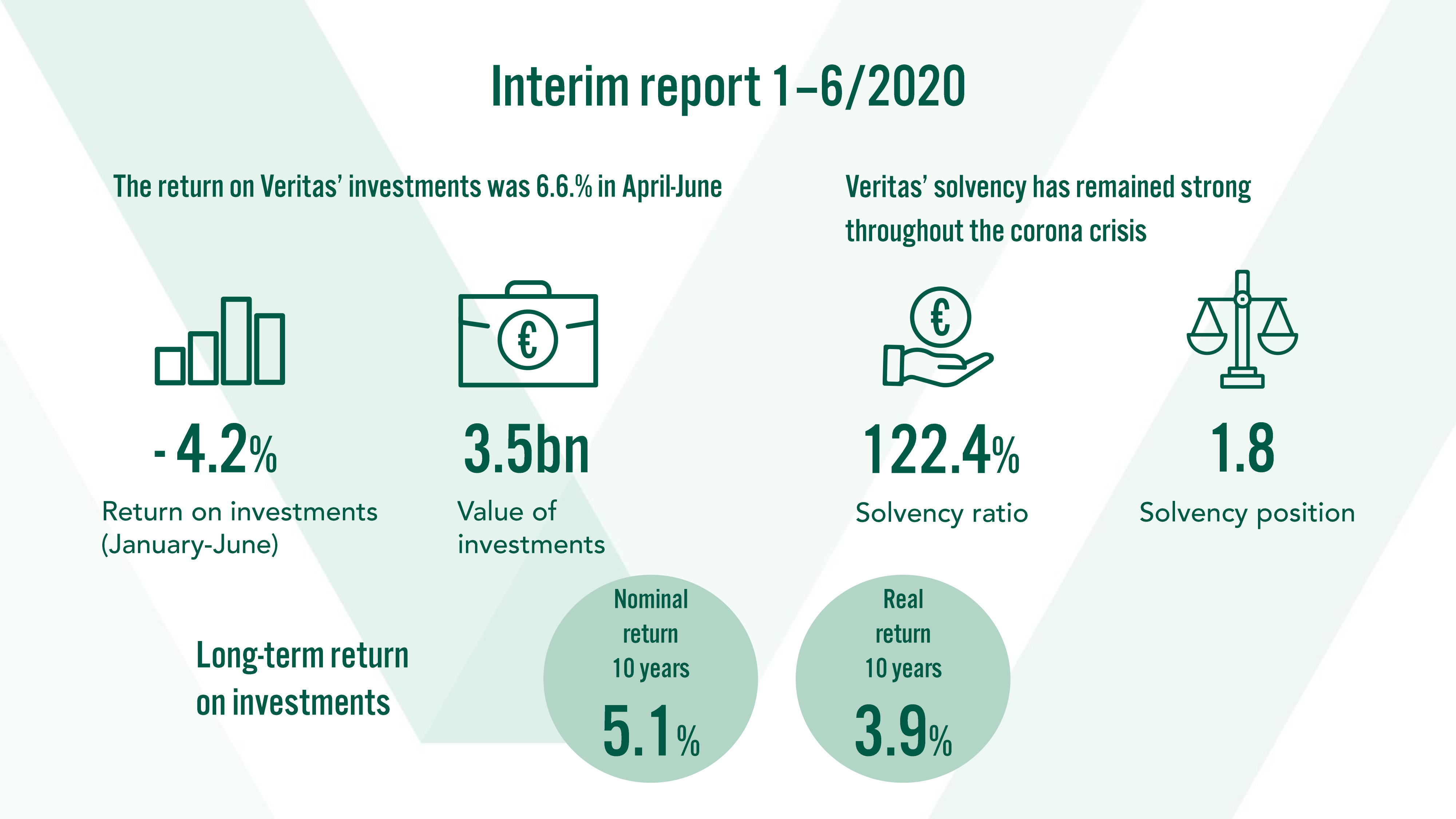

Return on investments at -4.2 per cent

The economy experienced an exceptionally significant collapse both in Europe and the United States during the second quarter of the year. The period of April–June was, however, one of recovery in the financial markets as a result of the monetary policy stimuli provided by the central banks and the fiscal support of the individual states.

‘For the first quarter of the year, we focused on securing our solvency and reducing the level of risk inherent to our investment portfolio. The recovery of the market has strengthened Veritas’ solvency and we have been able to increase our allocation to higher-yielding risk investments’, states Kari Vatanen, CIO of Veritas. ‘The share of equity investments was increased during the quarter by approximately ten percentage points.’

Despite the fact that the equity markets recovered from the trough experienced in March, a positive return was only achieved in real estate investments during the first half of the year. The return on Veritas’ investments was –4.2 per cent for the period of January–June. The return on fixed income investments was –0.2 per cent, equity investments –9.6 per cent, real estate 2.6 per cent and other investments –6.3 per cent.

Veritas’ solvency ratio was 119.2 per cent at the end of the first quarter of 2020, but it increased to 122.4 per cent during the second quarter. The company’s solvency position has remained at a good level throughout the entire corona crisis and was 1.8 by the end of June.

Growth in YEL policies

The impact of the corona epidemic was also reflected in Veritas’ other key figures. At the end of June, the estimated annual payroll for TyEL customers was EUR 2,122 million, compared to a payroll of EUR 2,159 million in 2019. The YEL income amount, on the other hand, saw a slight increase and the number of YEL insurance policies increased from the figure at the start of the year.

‘The spring has been quieter due to the pandemic, but we are pleased that an increasing number of entrepreneurs have decided to choose Veritas as their pension partner’, says Pettersson.

It is Pettersson’s opinion that society should now focus on ensuring smooth corona testing processes.‘During August, people have had to wait several days to get tested. That’s tough on companies and entrepreneurs who simply cannot carry out their business remotely’, explains Pettersson. ‘This type of delay is mentally difficult, but can also have a heavy financial impact. We absolutely need to focus on testing right now, as it will also help us to decrease the need for support packages in the future.’

Further information:

- Carl Pettersson, CEO, tel. +358 (0)10 550 1600, firstname.lastname@veritas.fi

- Kari Vatanen, CIO, tel. +358 (0)10 550 1882, firstname.lastname@veritas.fi

- Tommy Sandås, Financing Director, tel. +358 (0)10 550 1786, firstname.lastname@veritas.fi