Financial information and investments

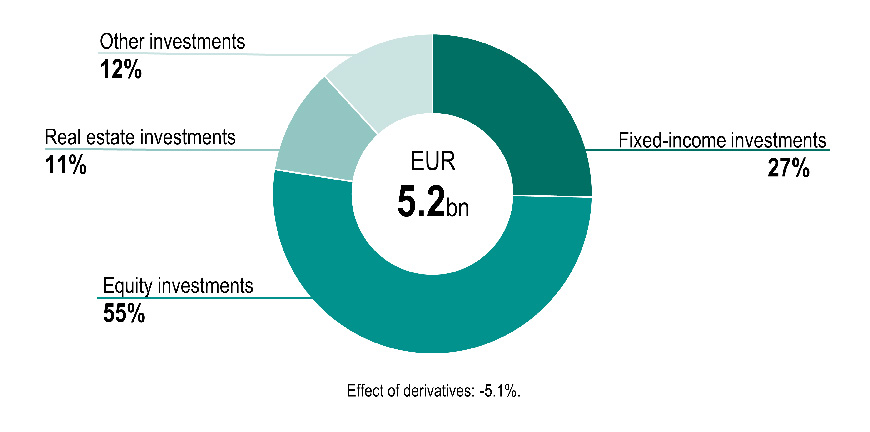

The return on Veritas’ investments was 8.7 per cent in 2025. The value of investments was EUR 5.2 billion at the end of year.

”Last year was a good year for all asset classes. At times, the equity markets took investors on quite a rollarcoaster ride, as tariff issues, the AI bubble and geopolitical uncertainty dominated the headlines. We kept a high exposure to listed equities throughout the year, and it paid off. Listed equities generated the best returns,” says Laura Wickström, CIO at Veritas.

In 2025, the return on Veritas’ fixed-term investments was 3.9 (6.7) per cent, equity investments 14.1 (12.7) per cent, real estate investments 3.5 (-0.7) per cent and other investments 3.9 (7.9) per cent.

”Investing in Finnish equities paid off last year, as the Helsinki Stock Exchange was one of the best stock markets, with an annual return of 35 per cent. European equities also performed well.”

- Press release: Veritas’ result in 2025: Pension insurance company Veritas’ investments returned 8.7 per cent (12 February 2026)

- Financial statement presentation 2025 (pdf)

Archive

News

Investment allocation by asset class

31 December 2025

Investment activities

We invest our accrued funds profitably and securely as a means of ensuring future pensions. The aim of our investment activities is to achieve the best possible return in order to ensure sustainable funding for pensions.

Our investment activities are professional, independent and responsible. We utilise a wide range of different revenue sources and diversify our investments internationally among different asset classes. Our investments comprise fixed-income investments, equity investments, real estate investments and other alternative investments.

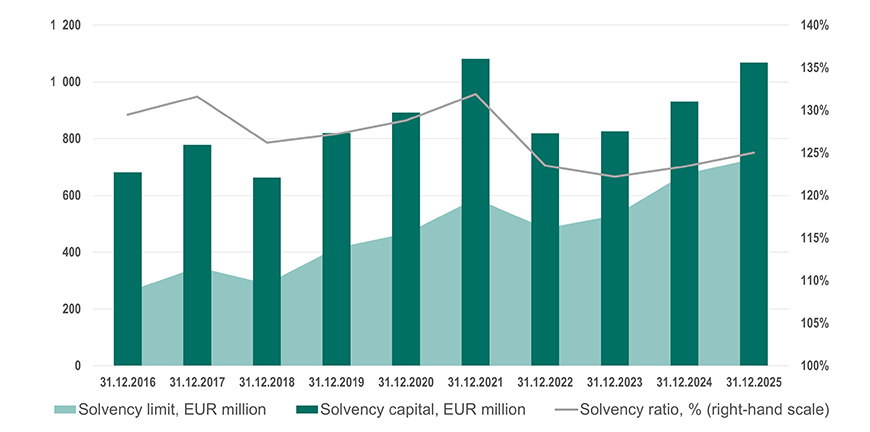

Solvency

Veritas’ solvency strengthened and the solvency position at year-end was 1.5 times the solvency limit. The solvency ratio was 125.0 per cent.

The solvency capital serves as a risk buffer for the purposes of our investment activities and against insurance risk. It determines the pension provider’s capacity to bear risk and pursue higher returns on investment activities. High investment returns increase a pension provider’s solvency and, correspondingly, the solvency decreases during weaker investment years.

Veritas’ solid solvency position safeguards pension funds

Ownership policy

The ownership policy outlines how we identify ourselves as an owner, what our expectations are and how we exercise our rights conferred by our holdings.

Market sounding

At Veritas, only Interim Chief Executive Officer Tommy Sandås, Chief Investment Officer Laura Wickström (all other investments than equities listed in Finland) and Equity Portfolio Manager Kim Fors (equities listed in Finland) are entitled to receive market soundings.

Market soundings must be sent by email (firstname.lastname@veritas.fi), unless the recipient has given express permission to use an alternative method.