The investments of pension insurance company Veritas returned 3.7 per cent in January–March. Strong growth continued also in customer acquisition.

“We once again achieved record figures for the sales of pension insurance policies during the first quarter of the year. We invest in customer service and there is demand for that. Our customers can trust that help is available whenever it’s needed”, says Carl Haglund, CEO of Veritas.

Haglund also views it as important that customer retention has improved. Customer confidence must, however, be earned anew each day.

“We have made a promise to answer calls in less than 20 seconds. Sometimes, customers find themselves in difficult situations and it’s important at those times that the customer gets the help and support they need.”

Finland’s economic development has been weak during the first quarter, but there are slight indications that improvements in the economic environment will be forthcoming towards the end of the year.

“Inflation has decelerated more than anticipated during the current year. Together with the predicted interest rate cut by the European Central Bank in June, this will support purchasing power.”

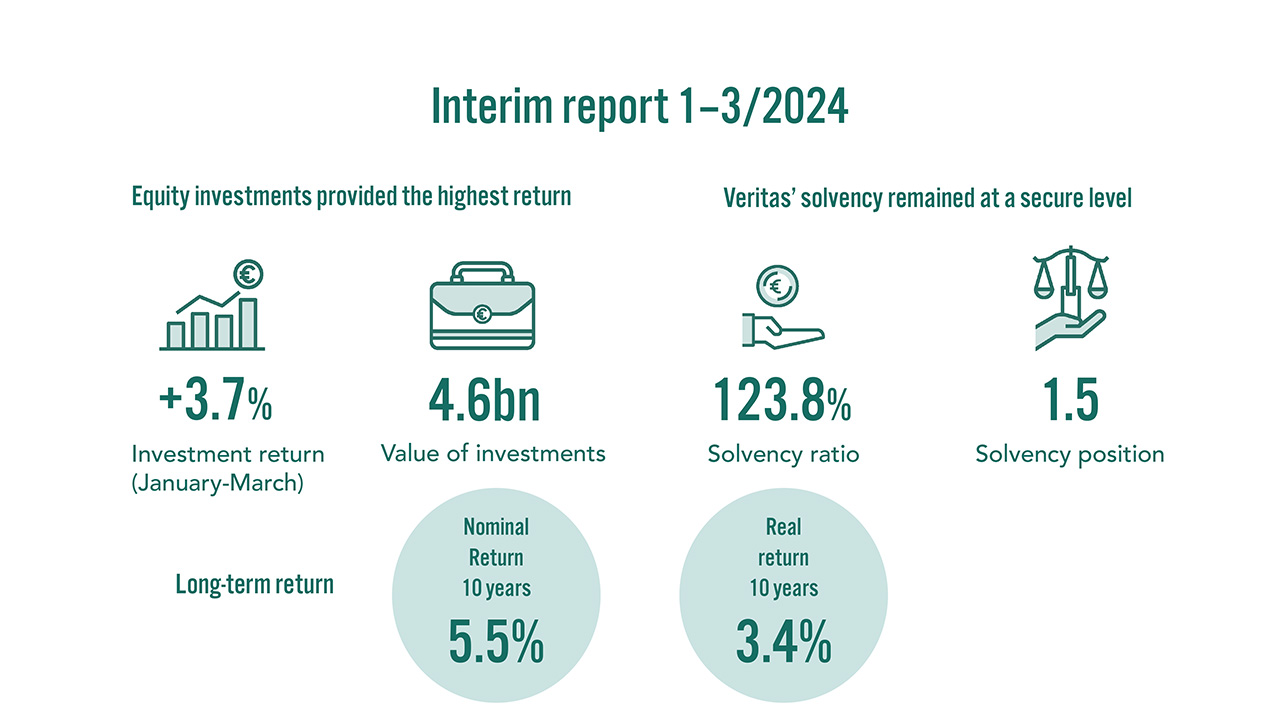

Veritas’ solvency position remained at a secure level and was, at the end of March, 1.5 times (1.7) the solvency limit. The solvency ratio was 123.8 (123.1) per cent.

Equity investments provided the highest return at the start of the year

The return on Veritas’ investments was 3.7 (1.6) per cent in the first quarter of the year. The return on fixed-income investments was 1.8 (2.0) per cent, equity investments 6.4 (2.4) per cent, real estate 0.6 (1.1) per cent and other investments 2.4 (-0.6) per cent.

“The first quarter of the year was surprisingly positive for the investment market and many aspects of the global economy look better than anticipated at the turn of the year”, says Kari Vatanen, CIO of Veritas.

Equity markets have performed well in the United States, Europe and Japan, but the development in the Finnish equity market has been weak. Veritas’ equity portfolio is globally diversified and the majority of it is invested in a cost-effective manner directly or through index funds.

“As the market environment has improved, we have further increased our equity exposure, which has had a very positive impact on our investment returns. Our fixed-income and alternative investments have had comparatively good returns during the first quarter of the year despite the increase in interest rates.”

According to Vatanen, Finnish equities are now relatively inexpensive compared to their international peers. The Helsinki Stock Exchange has been in decline for well over two years. The previous peak was seen in September 2021.

“It’s difficult to predict exactly when we may see a turn in direction. If exports begin to pick up and interest rates decline, it may be that the turn has already started. On the other hand, the weakening geopolitical situation could increase inflation risks and stir up headwinds for the entire investment market.”

Appendices:

Further information:

- Carl Haglund, CEO, tel. +358 (0)10 550 1600, firstname.lastname@veritas.fi

- Kari Vatanen, CIO, tel. +358 (0)10 550 1882, firstname.lastname@veritas.fi