Veritas Pension Insurance succeeded in attaining excellent investment returns in 2021. The return from investments during the year amounted to 12.6 per cent, i.e., close to EUR 0.5 billion. Equity investments generated particularly high returns of 25.2 per cent.

”Veritas reached impressive results both in investment activities and customer acquisition. Customer retention improved even further during the year, and we also gained a record-breaking number of new customers,” relays Tommy Sandås, Interim CEO of Veritas.

The year witnessed Veritas welcoming 4600 new YEL and TyEL insurance policies under its management. In terms of euros, the new premiums written amounted to close to EUR 80 million. At the close of the year, a total of 78 000 people were insured by Veritas. Veritas paid out pensions to nearly 38 000 recipients.

It has been a burdensome year for many of Veritas’ customer companies and entrepreneurs. Particularly small service sector companies have truly struggled during the COVID-19 era.

”At the moment it appears that the restrictions may soon be lifted. This is absolutely crucial, because COVID-19 has caused massive losses for so many entrepreneurs and corporations,” says Sandås.

Exceptionally high returns on equity investments

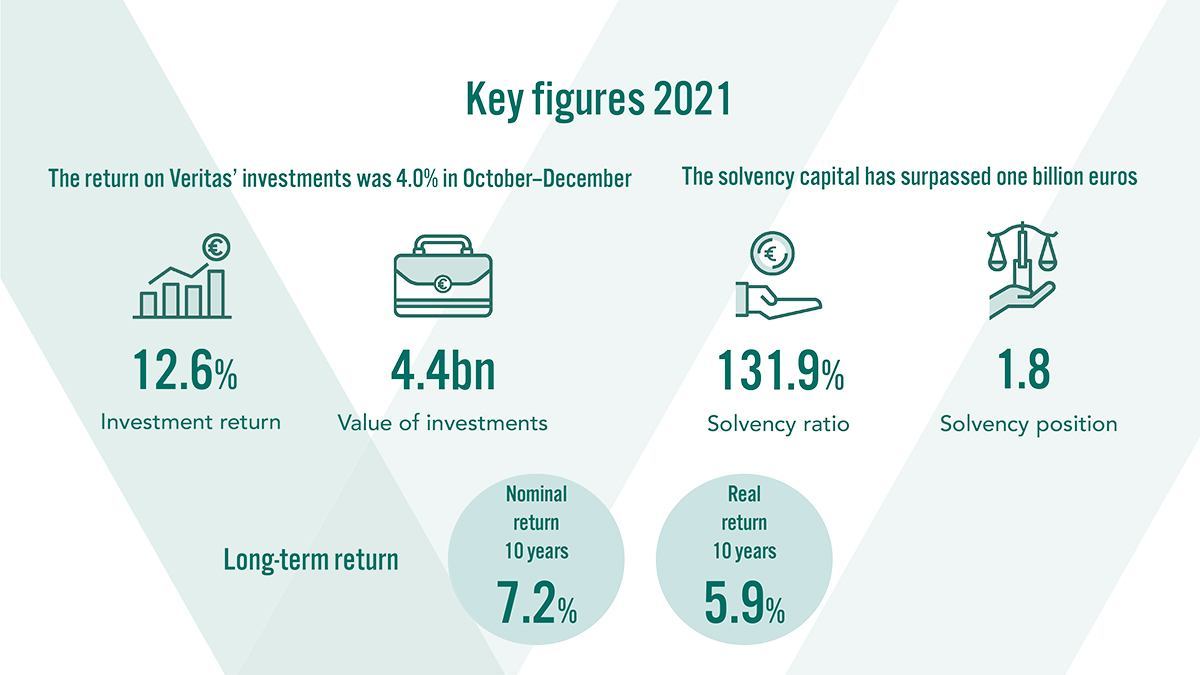

In the last quarter of the year, Veritas’ investments generated a return of 4.0 per cent, and during the entire year, of 12.6 per cent. Equity investments generated 25.2 per cent, real estate investments 9.5 per cent, fixed-income investments 1.6 per cent, and other investments 7.4 per cent.

”For us, the investment performance was the best ever during the 21st century. The return on equity investments reached exceptional heights, but also real estate investments and alternative investments proved to be a positive surprise,” says Kari Vatanen, CIO of Veritas.

In the past 10 years, Veritas’ investments have generated a return of just shy of 100 per cent. The average annual return during the said period amounts to 7.2 per cent.

Veritas’ solvency position has remained solid and has been further improved owing to the good investment performance. During the year, the solvency capital soared to well over one billion euros, representing an increase of 1.8-fold compared to the solvency limit. At the end of December, the solvency ratio amounted to 131.9 per cent.

Climate roadmap steering towards a carbon-neutral investment portfolio

In the investment market, the year 2021 was characterised by recovery measures and the ensuing inflation. Vatanen estimates that 2022 may become a year of deceleration, as central banks follow each other’s lead in curtailing their recovery measures and tightening their monetary policies.

”Year 2022 will be a challenging year for institutional investors. Tightening monetary policy and rising interest rates may be harmful for all asset classes, if the high valuations boosted by central bank stimulus begin to be questioned by the markets,” he relays.

In late 2021, Veritas published its climate roadmap for investments. The climate roadmap lists milestones that serve to steer investments towards carbon neutrality by the year 2035. The first goal is to reduce the carbon footprint of listed equity investments by 30 per cent and the carbon footprint of real estate investments by 80 per cent by the year 2025.

Appendices:

Further information:

- Tommy Sandås, Interim CEO, CFO, tel. +358 (0)10 5501 786, firstname.surname@veritas.fi

- Kari Vatanen, CIO, tel. +358 (0)10 550 1882, firstname.surname@veritas.fi