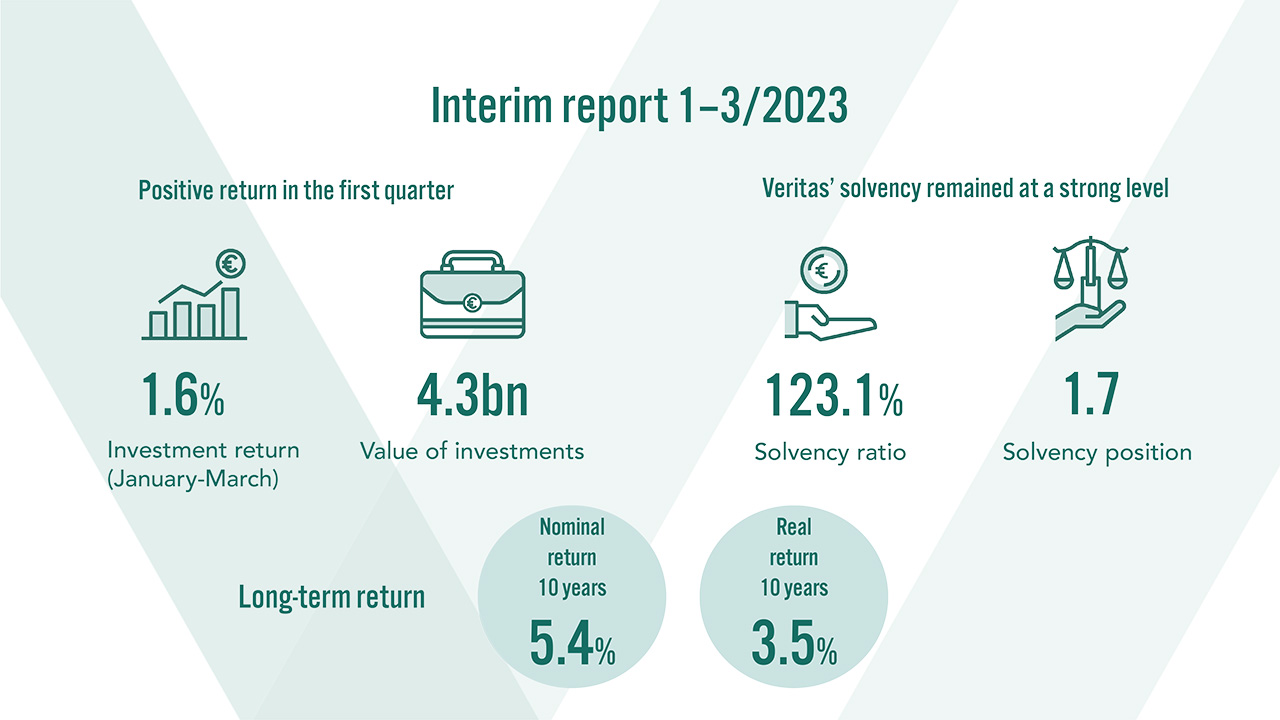

The investments of Pension Insurance Company Veritas returned 1.6 per cent in January–March. Solvency remained at a secure level and was, at the end of March, 1.7 times the solvency limit. In the beginning of the year, Veritas gained a record number of new customers.

“A record number of insurance policies were transferred to Veritas in the first quarter of last year, and this year that number was clearly exceeded. Customers appreciate the fact that, in addition to YEL and TyEL insurance policies, we also provide them with a dedicated insurance advisor,” says Carl Haglund, CEO of Veritas.

The payroll of the companies with insurance policies at Veritas continued to grow in the beginning of the year.

“The employment situation has remained on a good level even though the number of open positions took a downward turn towards the end of last year. Many industries suffer from a shortage of skilled labour, and the situation is not getting any better in the coming years.”

Careers have successfully been prolonged at the end but, according to Haglund, more attention should be paid to the beginning and middle phases of one’s career.

“We cannot afford to have young people retiring on disability pension at the current pace. In 2021, eight people under the age of 35 retired on disability pension for mental health reasons every day.”

Equity and fixed-income investments had a positive return

The return on Veritas’ investments was 1.6 per cent in the first quarter of the year. The return on fixed-income investments was 2.0 per cent, equity investments 2.4 per cent, real estate 1.1 per cent and other investments -0.6 per cent.

“The positive mood in the investment market has persisted although the problems experienced by certain banks caused turbulence in March. Equity and fixed-income investments had a positive return, contrary to the same time last year,” says Kari Vatanen, CIO of Veritas.

Headline inflation has continued to slow down and the price of energy, in particular, has decreased during the beginning of the year. The easing off of the worst fears regarding inflation has boosted market sentiment even though central banks have continued to tighten monetary policy by increasing key interest rates.

The increase in interest rates is likely to return a sense of realism to the investment market, now that the time of zero interest rates is over.

“With these interest rate levels, fixed-income investments are, again, a noteworthy option for institutional investors. The valuation levels of risk investments, on the other hand, will probably be tested if the central banks continue to increase interest rates.”

Carbon neutral investment portfolio by 2035

Veritas has managed to significantly reduce the carbon dioxide emissions of its investment portfolio during the years 2020–2022. As far as listed equities and corporate bonds are concerned, the weighted carbon intensity of the investment portfolio has reduced more than 40 per cent. Furthermore, properties owned by Veritas have started using both fossil-free electricity and district heating.

“We aim at achieving carbon neutrality for our investment portfolio by 2035. At the moment, we are ahead of our goals but the last stages will probably be more difficult to implement than the first steps we have taken.”

Appendices:

Further information:

- Carl Haglund, Chief Executive Officer, tel. +358 (0)10 550 1600, firstname.surname@veritas.fi

- Kari Vatanen, Chief Investment Officer, tel. +358 (0)10 550 1882, firstname.surname@veritas.fi